Connect Bank And Credit Card Accounts To Quickbooks Online

Tax services, Accounting Services?

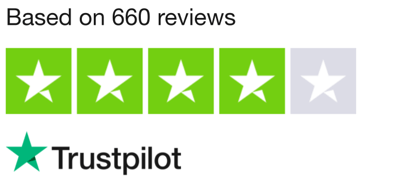

You Focus On Your Business, We Will Do Your Books. Independent QuickBooks Setup Services. We are one of the Best Advanced QuickBooks ProAdvisors in US

Monthly Accounting, BookKeeping Solution or One time help for Entrepreneurs and Small Businesses using Quickbooks and Sage Users

Connect with Pro Advisors, for all things Quickbooks

- Quickbooks Payroll Issue

- Quickbooks Error

- QuickBooks Accounting

- QuickBooks Accounting

Within the dynamic realm of financial management, companies are perpetually exploring methods to optimize workflows and augment productivity. The smooth transfer of credit card and bank transactions into accounting systems is crucial to this mission. Tools like QuickBooks Online are becoming increasingly important in this attempt as the digital world advances. This thorough tutorial will review the nuances of using “Right Books,” a top tool that streamlines and improves financial management for companies of all kinds, to link bank and credit card accounts to QuickBooks Online.

Not only is it a practical technological advancement, but the integration of bank and credit card accounts with QuickBooks Online is a calculated move that has the potential to transform how businesses manage their finances completely. By offering a reliable solution that fills the gap between financial institutions and accounting software, Right Books seeks to empower businesses. Let’s examine the rationale behind this integration’s importance for companies and how Right Books might spark progress.

Understanding the Landscape

1. Financial Visibility in Real Time

The real-time visibility into your financial situation that QuickBooks Online offers is one of the main advantages of linking your bank and credit card accounts. You can get the most recent information anytime; there’s no need to wait for monthly statements. With this instantaneous insight, finance experts and business owners may make quick, well-informed judgments.

2. Transaction Categorization Without Any Work

The laborious process of transaction classification is made easier with Right Books. Every transaction is automatically classified according to predetermined rules through smooth integration. This guarantees accuracy and consistency in your financial records while also saving time.

3. Getting Rid of Data Entry Mistakes

In addition to taking a lot of time, manual data entry is error-prone. Through transaction import automation, Right Books dramatically lowers the possibility of errors. This automation helps create a more dependable and error-free accounting system and saves time.

Solutions to QuickBooks Error 1935:

Linking Bank Accounts

Let’s now examine the thorough procedure for utilizing Right Books to link your bank accounts to QuickBooks Online.

Step 1: Logging into QuickBooks Online

Logging into your QuickBooks Online account is the first step. You must create an account if you’re new to QuickBooks. Upon logging in, proceed to the dashboard.

Step 2: Choosing ‘Banking’

Find ‘Banking’ on the left menu and click on it. You may manage all your linked accounts in the banking section by clicking here.

Step 3: Linking Your Bank Account

Choose your bank from the list of available banks by clicking on ‘Connect Account’. Enter your bank login details by following the instructions. Knowing that QuickBooks Online uses bank-grade security to protect your financial information is crucial.

Step 4: Procedure for Verification

QuickBooks Online will begin a verification procedure to ensure the information you supply is accurate when you input your credentials. Additional security measures, such as two-factor authentication, could be required.

Step 5: Mapping Accounts

You’ll be asked to map your bank accounts after verification. Account mapping is aligning your bank accounts with their QuickBooks Online counterparts. This step is essential to guarantee smooth synchronization between the two platforms.

Step 6: Transaction Syncing

QuickBooks Online will automatically sync your latest transactions after mapping. Now, the QuickBooks interface provides a real-time summary of your financial activity.

Ask for expert help!

Coming towards the end of this post, we hope that the information provided above will prove helpful in resolving the . If the error persists or if you encounter challenges while applying the suggested fixes, it’s advisable not to spend too much time attempting further solutions. Data damage problems can be sensitive, and attempting trial-and-error methods might lead to severe data loss.

Feel welcome to reach out to our professionals at Number. Our QuickBooks error support team is available 24/7 to assist you in resolving the issue without causing additional complications.

The Advantage of the Right Books

Right Books is the recommended option for companies looking to link their bank and credit card accounts to QuickBooks Online for the following reasons:

1. Interface Friendly to Users

Right Books is accessible to users with different levels of technological competence thanks to its user-friendly and straightforward interface. By streamlining intricate financial procedures, the platform frees users from having to deal with the complexities of the software and lets them concentrate on making strategic decisions.

2. Sturdy Security Measures

For Right Books, security comes first. The site uses industry-standard encryption and security procedures to protect your financial information. Right Books will treat your private information with the highest care and attention to detail.

3. Quick Integration with Online QuickBooks

The smooth integration of Right Books with QuickBooks Online gives users a unified experience. Your bank and credit card transactions will be precisely represented in your QuickBooks records thanks to the easy and effective synchronization process.

4. Transaction Categorization by Automata

Bid farewell to laborious manual transaction classification. This procedure is automated by Right Books, which helps you save time and lowers the possibility of mistakes. The software streamlines your financial workflow by intelligently classifying transactions according to pre-established standards.5. Adjustment for Varied Requirements

They understand that different businesses have different financial procedures. With customizable possibilities, Right Books can accommodate a wide range of needs. Regardless of your size—small startup or huge enterprise—the platform customizes its financial management solution to meet your unique needs.

It’s not merely a technical fix—integrating bank and credit card accounts with QuickBooks Online via Right Books is a calculated move that will help your company grow. More than just a tool, Right Books is a force for good in how companies handle their finances. Selecting the Correct Books will do more for you than just link accounts—it will open doors to a world of accuracy, efficiency, and strategic insights.

Adopting innovative solutions is necessary to stay ahead of the curve as the business landscape changes. With Right Books, you can confidently manage the financial landscape and concentrate on what matters—the expansion and success of your organization.

One thought on “Connect Bank And Credit Card Accounts To Quickbooks Online”

How to Delete Duplicate Transactions in QuickBooks

[…] Within the dynamic realm of financial management, companies are perpetually exploring methods to optimize workflows and augment productivity. The smooth transfer of credit card and bank transactions into accounting systems is crucial to this mission. Tools like QuickBooks Online are becoming increasingly important in this attempt as the digital world advances. This thorough tutorial will review the nuances of using “Right Books,” a top tool that streamlines and improves financial management for companies of all kinds, to link bank and credit card accounts to QuickBooks Online. […]