QuickBooks Desktop Payroll Taxes Submission

Tax services, Accounting Services?

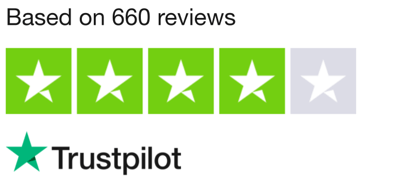

You Focus On Your Business, We Will Do Your Books. Independent QuickBooks Setup Services. We are one of the Best Advanced QuickBooks ProAdvisors in US

Monthly Accounting, BookKeeping Solution or One time help for Entrepreneurs and Small Businesses using Quickbooks and Sage Users

Connect with Pro Advisors, for all things Quickbooks

- Quickbooks Payroll Issue

- Quickbooks Error

- QuickBooks Accounting

- QuickBooks Accounting

Accounting software, QuickBooks has many features that make business management easy. For the payroll process, one can use QB desktop payroll. For businesses utilizing QuickBooks Desktop Payroll, the submission of payroll taxes is a critical aspect that should not be overlooked. Efficient and accurate payroll tax submissions are essential for maintaining compliance with tax regulations, avoiding penalties, and ensuring the financial health of your business. In this blog, we will explore the importance of QuickBooks Desktop Payroll Taxes Submission and why it should be a priority in your business operations.

- Compliance with Tax Regulations:

QuickBooks Desktop Payroll facilitates the accurate calculation and deduction of various taxes, including federal and state income taxes, Social Security, and Medicare taxes. Ensuring timely and accurate submission of these taxes is crucial for compliance with ever-changing tax regulations.

By using QuickBooks Desktop Payroll, businesses can automate tax calculations, keeping up-to-date with the latest tax rates and rules. This helps prevent errors in tax submissions, reducing the risk of audits and penalties.

- Avoiding Costly Penalties:

Failure to submit payroll taxes accurately and on time can lead to significant penalties from tax authorities. These penalties can accumulate quickly and have a substantial impact on your business’s financial stability.

QuickBooks Desktop Payroll provides tools to schedule and automate tax payments, helping businesses stay on top of their financial obligations. Timely submissions reduce the risk of penalties and contribute to a smooth, penalty-free tax filing experience.

- Employee Trust and Satisfaction:

Employees rely on their employers to manage payroll taxes accurately and efficiently. Timely and accurate payroll tax submissions ensure that employees receive their correct net pay and that their tax withholdings are handled appropriately.

Maintaining trust with employees is crucial for a positive workplace environment. When employees can rely on their employers to manage payroll taxes effectively, it contributes to overall employee satisfaction and confidence in the company.

- Financial Planning and Budgeting:

Accurate payroll tax submissions play a crucial role in your business’s financial planning and budgeting. By having a clear understanding of your tax obligations, you can plan for tax liabilities, avoid unexpected financial setbacks, and allocate resources more effectively.

QuickBooks Desktop Payroll’s reporting features enable businesses to generate detailed reports on payroll expenses, taxes paid, and other financial aspects. These reports provide valuable insights that can inform strategic financial decisions.

- Streamlining Administrative Processes:

QuickBooks Desktop Payroll integrates seamlessly with the overall accounting system, streamlining administrative processes. Automated tax calculations and submissions reduce the manual workload on the finance and HR teams, allowing them to focus on more strategic tasks.

By leveraging the capabilities of QuickBooks Desktop Payroll, businesses can save time and resources that would otherwise be spent on manual tax calculations and submissions.

Ask for expert help!

Coming towards the end of this post, we hope that the information provided above will prove helpful in resolving the . If the error persists or if you encounter challenges while applying the suggested fixes, it’s advisable not to spend too much time attempting further solutions. Data damage problems can be sensitive, and attempting trial-and-error methods might lead to severe data loss.

Feel welcome to reach out to our professionals at Number. Our QuickBooks error support team is available 24/7 to assist you in resolving the issue without causing additional complications.

What to do if QB desktop payroll tax submission doesn’t work?

Well, if you found that QuickBooks desktop payroll tax submission doesn’t work, then you can try to fix the problem. If you have no idea how QuickBooks desktop payroll tax submission works, then you can contact Right Books LLC for help. Our trained and experienced executives will properly help you so that you will learn how to use QuickBooks desktop payroll tax submission.

Fixing QuickBooks Desktop Payroll Taxes Submission errors may require a careful examination of the specific issue you’re facing. Here are some general steps you can take to troubleshoot and resolve common errors:

- Check for Software Updates:

Ensure that your QuickBooks Desktop software, including the Payroll module, is up-to-date. Intuit regularly releases updates that may include bug fixes and improvements. To update QuickBooks, go to the “Help” menu and select “Update QuickBooks.”

- Review Payroll Setup:

Double-check your payroll setup to ensure that all tax-related information, such as tax rates and filing frequencies, is accurate. Navigate to the “Employees” menu, select “Payroll Center,” and review your tax setup under the “Taxes & Liabilities” section.

- Verify Employee Information:

Ensure that all employee information, including addresses and Social Security numbers, is accurate and up-to-date. Incorrect employee details can lead to errors in tax calculations and submissions.

- Run Payroll Reports:

Generate payroll reports to identify discrepancies or errors. QuickBooks provides various reports, such as the Payroll Summary and Payroll Detail reports, which can help you pinpoint specific issues.

- Check for Tax Table Updates:

Verify that your tax tables are up-to-date. QuickBooks releases regular tax table updates to reflect changes in tax rates and calculations. To update tax tables, go to the “Employees” menu, select “Get Payroll Updates,” and follow the on-screen instructions.

- Review Employee Payroll Items:

Examine the payroll items associated with each employee to ensure they are set up correctly. Go to the “Lists” menu, choose “Payroll Item List,” and review each payroll item’s details.

- Recreate Payroll Tax Forms:

If you’re experiencing issues with specific tax forms, consider recreating them. Go to the “Employees” menu, select “Payroll Tax Forms & W-2s,” and then choose the form you need to recreate. Follow the on-screen instructions.

- Check Payroll Subscription Status:

Verify that your payroll subscription is active and up-to-date. Navigate to the “Employees” menu, select “My Payroll Service,” and choose “Account/Billing Information” to confirm your subscription status.

What to expect from Right Books LLC?

Right Books is an authentic and reliable QuickBooks software reseller and assists QuickBooks users. We have a team of skilled and qualified experts and we offer high-quality service. So, whether you want a quick resolution of any QuickBooks-related trouble, 24×7 support, or assistance to use it, connect with Right Books LLC.

We are reachable via call, message, and email. You can choose any mode of communication to reach our executives and ask for help.

Conclusion:

QuickBooks Desktop Payroll Taxes Submission is not just a routine task; it is a fundamental aspect of responsible and efficient business management. By prioritizing accurate and timely submissions, businesses can ensure compliance, avoid penalties, foster employee trust, and enhance overall financial well-being. QuickBooks Desktop Payroll serves as a valuable tool in this process, providing businesses with the tools they need to navigate the complexities of payroll tax management successfully.

5 thoughts on “QuickBooks Desktop Payroll Taxes Submission”

How to resolve QuickBooks Error 6147 - Rightbooksllc

[…] See Also: QuickBooks Desktop Payroll Taxes Submission […]

How To Fix Quickbooks Error 102 - Rightbooksllc

[…] See Also: QuickBooks Desktop Payroll Taxes Submission […]

QuickBooks Loan Manager Not Working Error - Rightbooksllc

[…] See Also: QuickBooks Desktop Payroll Taxes Submission […]

How to Resolve QuickBooks Error 12031 - Rightbooksllc

[…] See Also: QuickBooks Desktop Payroll Taxes Submission […]

How to Change Registered Email Address in QuickBooks

[…] See Also: QuickBooks Desktop Payroll Taxes Submission […]