How to Reconcile Payroll Liabilities in QuickBooks?

Tax services, Accounting Services?

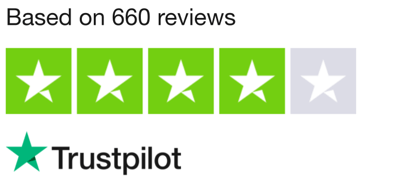

You Focus On Your Business, We Will Do Your Books. Independent QuickBooks Setup Services. We are one of the Best Advanced QuickBooks ProAdvisors in US

Monthly Accounting, BookKeeping Solution or One time help for Entrepreneurs and Small Businesses using Quickbooks and Sage Users

Connect with Pro Advisors, for all things Quickbooks

- Quickbooks Payroll Issue

- Quickbooks Error

- QuickBooks Accounting

- QuickBooks Accounting

In QuickBooks, reconciling payroll liabilities refers to ensuring that the amounts you owe for various payroll-related items, such as taxes and benefits, match the figures in your accounting records. This reconciliation process is essential for maintaining accurate financial records, complying with tax regulations, and avoiding discrepancies in your payroll accounts.

Managing payroll in any business involves numerous responsibilities, one of which is ensuring accurate and up-to-date reconciliation of payroll liabilities. QuickBooks, a widely used accounting software, simplifies this process with its user-friendly interface and robust features. In this guide, we’ll walk you through the steps to reconcile payroll liabilities in QuickBooks, ensuring that your financial records remain accurate and compliant. Before we see how to reconcile Payroll Liabilities in QuickBooks, let’s have a glance at its breakup.

Understanding Payroll Liabilities:

Before diving into the reconciliation process, it’s crucial to understand what payroll liabilities are. Payroll liabilities include taxes, benefits, and other deductions that employers owe but still need to pay. These may include federal and state income taxes, Social Security and Medicare taxes, and employee benefits like health insurance and retirement contributions.

Payroll Liabilities:

Payroll liabilities include amounts that your company owes but has not yet paid. This can include payroll taxes (such as federal and state income taxes, Social Security, and Medicare taxes), benefits, and other withholdings.

Payroll Liabilities Report:

QuickBooks provides a Payroll Liabilities Report that summarizes the amounts owed for various payroll-related items. This report helps you identify and verify the liabilities associated with each employee and the company.

Adjustments:

During the reconciliation process, you may identify discrepancies between your records and the actual liabilities. QuickBooks allows you to make adjustments to correct these discrepancies. This could involve adding or removing liabilities, adjusting amounts, or fixing any errors.

Pay Liabilities Feature:

QuickBooks offers a “Pay Liabilities” feature within the Payroll Center. This feature allows you to review and pay outstanding liabilities directly from QuickBooks, ensuring that your payments are accurately recorded in the system.

Reconciliation Process:

Similar to bank account reconciliation, the reconciliation process for payroll liabilities involves comparing the amounts in QuickBooks with the actual liabilities you owe. This process helps identify any discrepancies that need to be addressed.

Reports and Documentation:

QuickBooks provides various reports related to payroll liabilities, such as the Payroll Liabilities Report and reconciliation reports. Keeping accurate documentation of the reconciliation process is crucial for record-keeping and audit purposes.

Frequency:

It’s advisable to reconcile payroll liabilities regularly, such as on a monthly or quarterly basis, to catch any discrepancies early and ensure compliance with tax regulations.

See Also: How to resolve QuickBooks Error 15106

Step-by-Step Guide to Reconciling Payroll Liabilities in QuickBooks:

- Navigate to Payroll Center:

Open QuickBooks and go to the “Employees” menu.

Select “Payroll Center” from the dropdown menu.

- Access Liabilities Tab:

In the Payroll Center, click on the “Liabilities” tab.

Here, you’ll find a list of your current payroll liabilities.

- Review Liabilities:

Take a moment to review the list of liabilities displayed. Ensure that each liability corresponds to the correct tax agency or benefit provider.

- Verify Transactions:

Click on each liability to review the associated transactions.

Check if the transactions match your records and reflect the accurate amounts.

- Check for Unpaid Liabilities:

Look for any unpaid liabilities in the “Upcoming Liabilities” section. This includes upcoming tax payments and benefit contributions.

- Reconcile Liabilities:

Click on the “View/Pay” button next to each liability.

Compare the liabilities shown in QuickBooks with your records.

If everything is accurate, mark the liabilities as reconciled.

- Make Adjustments if Necessary:

If you find any differences, make the appropriate corrections.

Double-check that the adjustments align with the correct payroll period.

- Record Payments:

Record payments made for each liability. QuickBooks allows you to enter payment information directly within the Payroll Center.

- Run Payroll Reports:

Generate payroll reports to confirm that your payroll liabilities are now reconciled.

QuickBooks offers various reports, such as the Payroll Detail Review, to help you verify the accuracy of your payroll data.

Tips for Successful Reconciliation:

Regular Reconciliation:

Ensure that you reconcile your payroll liabilities regularly, preferably after each payroll run, to catch any discrepancies promptly.

Backup Your Data:

Before making adjustments or reconciling, create a backup of your QuickBooks data to avoid data loss.

Stay Informed:

Keep yourself updated on changes in tax rates, regulations, or any modifications to employee benefits that may affect your payroll liabilities

Connect with QuickBooks payroll support

Right Books provides a comprehensive Help Center with resources and guides. Utilize these resources if you encounter challenges during the reconciliation process.

So, if you are unable to reconcile payroll liabilities in QuickBooks software, then you should contact Right Books LLC for help. The experienced and talented QuickBooks payroll support executive will assist you correctly.

You can connect with us anytime because our executives are 24×7 available to resolve technical issues and guide QuickBooks users. So, you do not need to worry, if you wish to know “How to reconcile payroll liabilities in QuickBooks” follow the instructions of this blog. If you face any trouble then you can connect to Right Books for help.

Conclusion:

Reconciling payroll liabilities in QuickBooks is a vital aspect of maintaining accurate financial records and compliance with tax regulations. By following this step-by-step guide and staying proactive in your reconciliation efforts, you can ensure that your payroll data remains precise, reducing the risk of errors and ensuring smooth financial operations for your business. To fix any trouble related to QuickBooks, Right Books is the best place, so connect with us and find solutions to each QuickBooks issue.

Ask for expert help!

Coming towards the end of this post, we hope that the information provided above will prove helpful in resolving the . If the error persists or if you encounter challenges while applying the suggested fixes, it’s advisable not to spend too much time attempting further solutions. Data damage problems can be sensitive, and attempting trial-and-error methods might lead to severe data loss.

Feel welcome to reach out to our professionals at Number. Our QuickBooks error support team is available 24/7 to assist you in resolving the issue without causing additional complications.

FAQs related to QuickBooks Error 15271

QuickBooks Error 6143 can be triggered by various factors, including damaged company files, incomplete software installations, Windows registry issues, malware infections, or conflicts with other applications.

To prevent Error 6143, regularly backup your QuickBooks company files, keep your software updated, run reliable antivirus software, and avoid interruptions during QuickBooks processes.

Yes, QuickBooks File Doctor is a specialized tool designed to detect and resolve file-related issues, including Error 6143. Running this tool can often help in fixing the problem.

Renaming .ND and .TLG files is a common troubleshooting step for Error 6143. It’s safe to rename these files as QuickBooks will recreate them when you open your company file.

If the provided solutions don’t resolve Error 6143, consider seeking expert assistance from QuickBooks professionals or contacting customer support for specialized guidance tailored to your specific issue. They might provide advanced troubleshooting steps or solutions.

One thought on “How to Reconcile Payroll Liabilities in QuickBooks?”

Quick Fix for QuickBooks Error 1935 - Simple Solutions Revealed

[…] ensuring that your financial records remain accurate and compliant. Before we see how to reconcile Payroll Liabilities in QuickBooks, let’s have a glance at its […]